Receive up to $26,000 per employee in FREE Government Aid with the Employee Retention Credit.

About The ERC Program

What is the Employee Retention Credit (ERC)?

ERC is a stimulus program designed to help those businesses that were able to retain their employees during the Covid-19 pandemic.

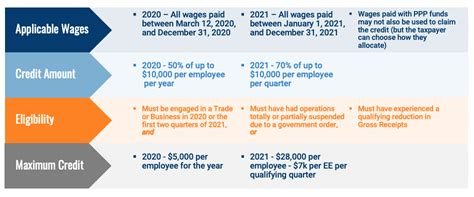

Established by the CARES Act, it is a refundable tax credit - that you can claim for your business. The ERC is available to both small and mid-sized businesses. It is based on qualified wages and healthcare paid to employees.

- Up to $26,000 per employee

- ERC is 100% Refundable meaning NO REPAYMENT IS REQUIRED

- Available for 2020 and 3 quarters of 2021

- Qualify with decreased revenue or COVID event

- No limit on funding

Our Services

- Thorough evaluation regarding your eligibility

- Comprehensive analysis of your claim

- Guidance on the claiming process and documentation

- Specific program expertise that a regular CPA or payroll processor might not be well-versed in

- Fast and smooth end-to-end process, from eligibility to claiming and receiving refunds